People braced for the worst: a stock market crash. Huge investment banks and major lenders began to go under. Even worse, because investors around the world had purchased subprime mortgages as securities, the whole global economy suffered from the American subprime fallout. And since nonconsumer banks and institutions had become so heavily invested in the subprime market, almost all areas of finance became infected with worthless mortgages. In 2006, before the subprime fallout, Countrywide made more than $2.5 billion in profits.

home loan lender, Countrywide, reported $1.5 billion in lost revenue during the second half of 2007. īut the huge mortgage lenders who actually paid out the money to borrowers to purchase these homes suddenly found that the revenue from their monthly payments was drying up - quickly. Combined with additional factors, like auto industry workers who were part of a massive layoff and real estate speculators who had purchased homes with ARMs, some people simply walked away from their homes - and the loans that went with them. As interest rates on ARMs reset and increased, so, too, did monthly payments on home loans. Let's look at this dispersal like a metastasizing cancer. īecause financial institutions like investment banks and securities companies had purchased these mortgages, the risk from any fallout was spread across the financial spectrum. Many subprime mortgages were purchased by stock brokers, lumped together into portfolios, and sold as securities. The result was that mortgages could be bought and sold easily. But in the mid-1990s, restrictions covering loans were eased as part of an effort to extend home ownership to more Americans. Under previous banking regulations, banks simply issued mortgages and kept them, accepting payments over 15 or 30 years until the loan was paid off. These foreclosures may not have had the sweeping effect on the American economy that they did had they not carried so many implications for other areas of the financial world. As a result, home foreclosures in the United States increased 75 percent from 2006 to 2007. This increased monthly mortgage payments, often to amounts a homeowner couldn't afford. The interest rates on these loans reset, generally after two years, and at a higher rate. Many of these subprime mortgages were issued as adjustable rate mortgages ( ARMs). In many cases, they were given for amounts people couldn't otherwise afford. Often, these loans were given with attractive terms, like low initial interest rates and no down payment. Subprime mortgages offered home loans to borrowers who posed a high credit risk. This was thanks in large part to the subprime mortgage fallout. In 2007, things began to look bleak on the American stock market. The failure of one section of the economy can lead to another and so on. When things look bleak, however, a chain reaction of misfortune tends to occur. When the market is perceived as healthy - meaning the dollar is strong, the trade deficit is narrow, and the value of companies is high - investment begets investment. The stock market is all about perception. How bad would things have to get for the government to step in? Find out on the next page.

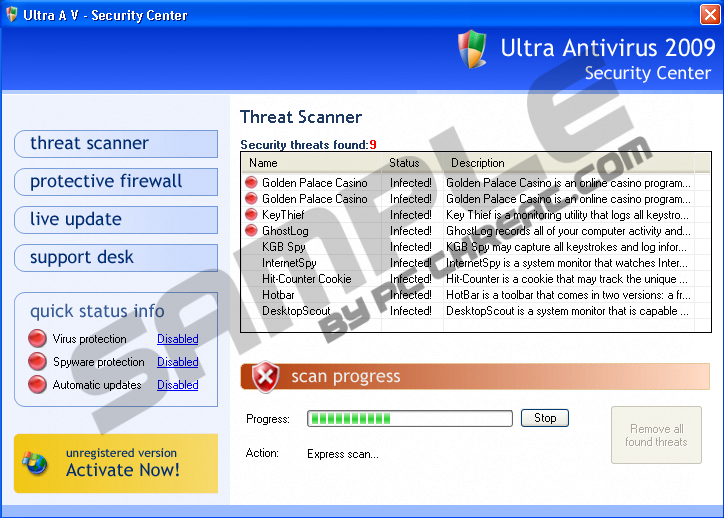

#TOTALAV STOCK FREE#

But despite the government's efforts to prevent another stock market crash, in theory, a free market society isn't supposed to have any intervention in its economy. The federal government has made several efforts to keep the markets from falling. This time, the economy was brought to the brink by something called the subprime mortgage. In 20, the American economy found itself once again teetering on the edge of another economic slide. The total amount of value that tech companies lost that year came to an estimated $800 billion. In 2000, the stock market crashed again when the dot-com bubble burst and highly inflated Internet and tech companies lost their value all at once. This crash is thought to have been generated by a weak dollar and a sudden fleeing of foreign investors. In 1987, another stock market crash caused the Dow to drop 508 points in one day - a loss of 22.6 percent of value.

Some historians think that a crash in the Florida real estate market was one of the factors that led to the crash of 1929 and the Great Depression that followed.

0 kommentar(er)

0 kommentar(er)